Strategy

We primarily opt for a bottom-up approach when analyzing potential investments and seek companies with strong economic moats as well as sound fundamentals. Through rigorous peer review of valuation models, research, and quantitative and qualitative investment rationales, we seek to continuously outperform our benchmark, the S&P 500 Total Return index, on a risk-adjusted basis while remaining within our compliance.

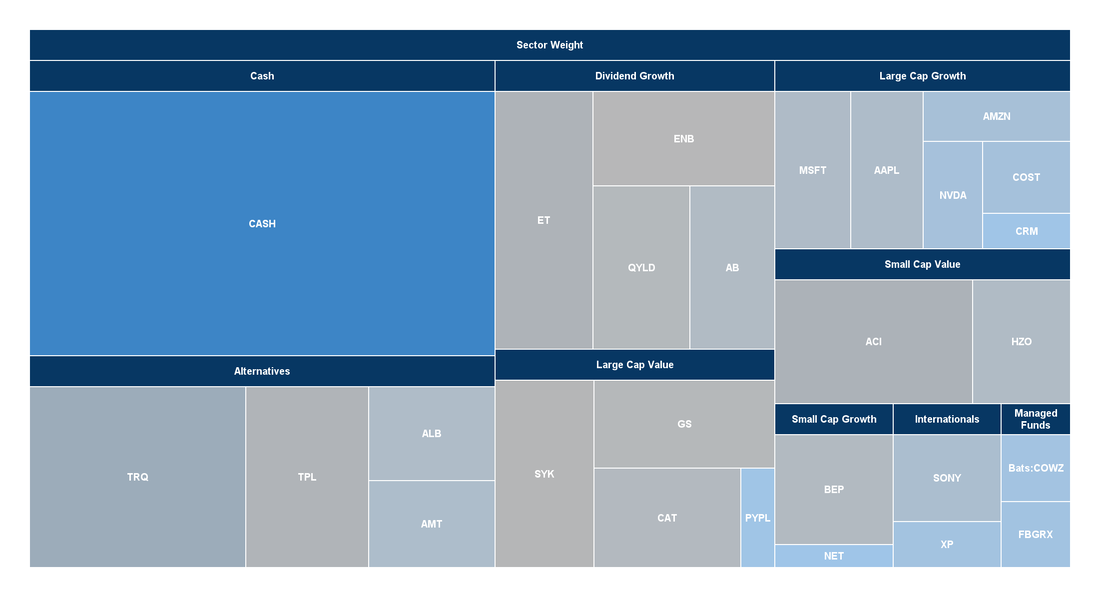

Our holdings stretch across many different industries and we designed our club structure accordingly. Members of the Analyst Program spend their time covering one sector closely and as a result develop an intimate understanding for their respective coverage universe. These sectors include: Large Cap Value, Large Cap Growth, Small-Mid Cap Value, Small-Mid Cap Growth, Internationals, Dividend Growth, Managed Funds and Alternatives. Each division is weighted according to economic forecasts and expected cyclical behavior.

The current Vice President of Portfolio Management, Elias Giannakopoulos, will be updating this page constantly to keep transparency with the portfolio. There will be a semester report on overall trends, portfolio foresight, and any transactions made throughout the past semester.

Our holdings stretch across many different industries and we designed our club structure accordingly. Members of the Analyst Program spend their time covering one sector closely and as a result develop an intimate understanding for their respective coverage universe. These sectors include: Large Cap Value, Large Cap Growth, Small-Mid Cap Value, Small-Mid Cap Growth, Internationals, Dividend Growth, Managed Funds and Alternatives. Each division is weighted according to economic forecasts and expected cyclical behavior.

The current Vice President of Portfolio Management, Elias Giannakopoulos, will be updating this page constantly to keep transparency with the portfolio. There will be a semester report on overall trends, portfolio foresight, and any transactions made throughout the past semester.

Research Databases

ALPHA VANTAGE STOCK API

The Seidman Investment Portfolio Organization, Grand Valley State University's student-run investment organization, provides unparalleled investing insight and exclusive networking opportunities for members. IPO participates in market research, investment selection, and hosts professional speakers throughout the year. Our mission is to equip students to comprehend the driving forces of market trends through encouraging fastidious peer review of valuation models, research, and investment theses.

Our student organization’s Excel stock data integration is powered almost exclusively by Alpha Vantage Stock API. These services allow IPO student members to access time series market data, technical indicators, and forex/crypto data feeds through our proprietary Excel interface that will be available to our students throughout the semester. You may also refer to a supplementary stock API primer that outlines the key financial data concepts (e.g., split/dividend adjustments, market-wide aggregation, etc.) as you develop your own investment portfolios.

Our student organization’s Excel stock data integration is powered almost exclusively by Alpha Vantage Stock API. These services allow IPO student members to access time series market data, technical indicators, and forex/crypto data feeds through our proprietary Excel interface that will be available to our students throughout the semester. You may also refer to a supplementary stock API primer that outlines the key financial data concepts (e.g., split/dividend adjustments, market-wide aggregation, etc.) as you develop your own investment portfolios.

S&P Capital IQ

The S&P Capital IQ platform combines deep and broad global financial intelligence with an array of tools for analysis, ideation, and efficiency. This platform includes profiles for over 62,000 public companies and 4.4 million private companies, in-depth global data for 17 industries, and data related to inflation, employment, GDP, trade, currency and more.

WRDS

Wharton Research Data Services (WRDS) is the award-winning research platform and business intelligence tool for over 40,000+ corporate, academic, government and nonprofit clients at over 400+ institutions in 30+ countries. WRDS provides the user with one location to access data across multiple disciplines including Accounting, Banking, Economics, Finance, ESG, and Statistics. GVSU’s subscription includes access to S&P Global Market Intelligence/Capital IQ and CRSP U.S. Stock database. CRSP contains end-of-day and month-end prices on primary listings for the NYSE, NYSE MKT, NASDAQ, and Arca exchanges, along with basic market indices.

Please reach out to [email protected] or [email protected] for any inquiries regarding the portfolio.